Download these best budget apps to help you conserve cash, spending plan for upcoming costs as well as prevent the costs that come from overdraft or late costs. Discovering a good budget plan is no small job, but with these budgeting and loan apps for iPhone and Android you can keep your financial resources in check during 2017.

You can use these budgeting apps to turn your iPhone or Android into a personal financing advisor that can help you know when to invest loan, identify where you lose money and how you can get rich by budgeting your cash.

There’s no need to invest an hour every day working on a spending plan when the best individual finance apps automate much of it and assist you quickly discover routines and alert you to costly cash mistakes prior to they occur.

We’ve simply added a brand-new app that automatically conserves money on the edge of your budget plan to help you build out an emergency fund without the hassles of regular budgeting.

If you prefer to earn more money rather of budgeting or have already maxed out your budgeting powers, have a look at the best apps to make cash to begin earning money on the side today. A few of them will let you start making money working from home or while you do things you already need to do anyhow. As you deal with a budget plan, take a look at the best apps to save cash, which will assist keep more money in your wallet.

Whether you are attempting to get your finances in order now that kids are back in school, a college student aiming to budget plan for the first time or getting a running start on conserving for Black Friday– the best budgeting apps on the marketplace can make it simple.

With these tools you can enhance your spending plan to identify where you are squandering cash you can use these apps to hit your financial objectives.

We’ve used these apps to avoid paying overdraft costs, pay for debt and construct our savings in 2015, and work towards a much better monetary future in 2017.

The best budget apps for 2017 focus on assisting you discover you spend you money without manually logging every purchase. You can link the majority of these to a bank account to instantly see where you invest loan, get informs for expenses and see how much loan you have left for a specific item or area of your budget plan.

Best Budget Apps

- Mint Budgeting App

- PocketGuard Budget App

- You Need a Budget

- GoodBudget

- Mvelopes

- HomeBudget

- Wally

- Level Money

- Spendee

- BUDGT

- Unsplurge

- Digit bot

- Albert

- Why You Need a Budget

Here are the best spending plan apps for 2016 that can help you save cash, prevent unnecessary fees and put you on a path to constructing an emergency fund and other wise loan moves. We’re putting these to use as part of our goal to save more of our cash and quit losing it like we have an unlimited supply.

Most of these best budgeting apps are free to use, and those that aren’t are often much less than you would spend on one bank charge. Among the alternatives is $50, but it is one that numerous users swear by.

Mint Budgeting App

Mint is one of the best spending plan apps due to the fact that it takes the trouble out of making a budget. You connect the Mint app to your bank and the app can use your information to assist produce a personalized budget plan.

The Mint app uses the very same security as banks and the team behind this service also makes TurboTax and Quicken, so you can trust that they take all possible actions to protect your accounts and your information.

Mint will send you alerts to uncommon charges and assists identify ideas customized to your spending that can help you reduce the money you invest in charges and on other bills. Mint likewise includes your credit rating, so you can see a big picture view of your spending plan and your individual financial resources.

With the Mint apps for iPhone, iPad and Android you can see your spending plan anywhere and there is also an online component to take a look at from your computer system and a bill pay component to assist you manage and pay your bills in one location.

PocketGuard Budget App

The PocketGuard budget app connects directly to your checking account so that you can constantly have access to your present deals and balance. The feature that stood apart to us when we began utilizing it is the ability to see money in easy terms.

On the home screen there is a number that reveals you how much cash is in your pocket now, your income and how much you have actually invested. The app analyzes your spending to recognize repeating payments that you need to prepare for and can recognize your income so that you have a good idea of your cashflow.

Easy charts lay out where you spend your cash, and a tap shows what you are investing in each catagory. This is a vital tool in discovering places to cut down and to optimize your purchases.

PocketGuard works on iPhone, Android and online. There is likewise an Apple Watch element.

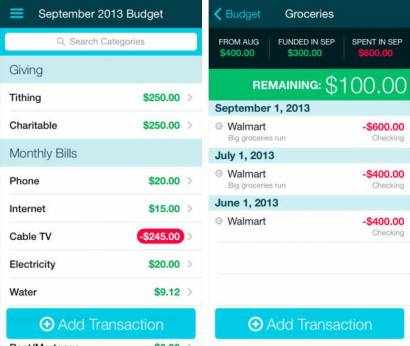

You Need a Budget

You Required a Budget is more than just a declaration about why you read this guide of the best budget plan apps for 2017. You Required a Spending plan is a budget system that assists you develop a budget that you can follow.

YNAB, or You Need a Spending plan, focuses on 4 guidelines to help you get your life in order with simple changes. Provide every dollar a job, plan for irregular expenses, roll with the punches if you spend too much and find out how to reside on last month’s income.

With these four guidelines you can skip the pain of a budget and concentrate on building a much better monetary life utilizing a budgeting app that works for you.

In addition to assisting you budget plan there are classes that you can watch online to help get started, free with the service.

You can try YNAB complimentary for 34 days and after that it is $50 for the year or $5 a month to use thr service that deals with your computer, iPhone and Android.

GoodBudget

GoodBudget is a digital envelope budget plan system that assists you manage your finances using the envelope budgeting technique without bring around a stack of envelopes when you need to pay. It’s an envelope spending plan for the digital age.

Instead of aiming to reconcile envelopes with a partner later, your budgets sync throughout all of your devices from iPhone to Android so everybody knows where money is going. The app can help you discover how to save for huge purchases and really put that plan into place so you can save for holiday or a brand-new car.

GoodBudget is available on iPhone and Android as a free app, with $15 for three months or $24 for six months of a professional memberships that deliver more envelopes, spending plan history, accounts and devices.

Mvelopes

Mvelopes is another outstanding budgeting app to assist you get ahold of your finances in 2017. You can link your bank account to this app to make it work and it is another digital envelope spending plan technique app that can help you stay on track.

You can pay costs, manage your spending plan and strategy all from your iPhone or Android. You can likewise capture your invoices to track costs in real-time so that everybody can see your budget as it is, not as it remained in the morning.

In addition to the Mvelopes iPhone and Android app there are likewise Mvelopes tablet apps for iPad and Android with more comprehensive views so that you can do bigger planning on a tablet. Mvelopes is totally free to use, with a $95 a year premium alternative and a cash coach alternative too.

HomeBudget

With the Home Budget plan with Sync app for iPhone, iPad, Android, Mac and Windows you can sync a personal spending plan in between all your devices. You do have to purchase the app on each platform you wish to use it on, which is a drawback, but there is a lot of versatility for users who desire a more hands on method to budgeting.

With HomeBudget you can share between family members and between your devices so you see the very same budget on all of your devices.

HomeBudget is an excellent choice for users who want to be able to do a great deal of manual manipulation. This is not the best budgeting app for each user, however for those who desire a great deal of control it is an outstanding choice.

HomeBudget is $5.99 on iPhone and iPad, $5.99 on Android, $19.99 on Mac and $14.99 on Windows.

Wally

Wally is a budgeting app that is basically a beautiful expense tracker for individuals. Just like you may track costs for a work trip, you can do that for your personal budget with Wally.

The Wally app is completely complimentary and it lets you log your costs with a manual entry or with a picture of your receipt. If you use area services Wally can even determine where you are at to save you a step when logging an expense.

You’ll get notifications when an expense is due, when you hit a savings goal and with other activities. Wally can adapt to your habits and goals to help you arrive.

Wally is totally free and is offered for iPhone and Android.

Level Money

Level Cash assists you adhere to a spending plan by revealing you what you can invest today, this week and this month.

The Level Cash app can discover your income and costs then reveal you what you can invest. The app likewise helps you find out how to conserve for bigger purchases or pay down financial obligation.

Like a number of the best spending plan apps, you can connect this to a lot of significant banks. There are goals for spending and saving, plus a preparation component to assist you stay with your goals without the inconveniences of a normal budget plan.

Level Loan is totally free on iPhone and Android.

Spendee

Spendee isn’t a budget app in the traditional sense, but it does assist you find out how you are investing your money. This is an essential part of making better cash decisions and setting up a budget.

If you want to start, you can use Spendee to find out where you are spending cash with an easy to use interface that lets you track your cash and credit or debit purchases with just a few swipes.

After you track your costs, you can want to see where you invest your loan later on so that you have a stunning view of where your cash is going and you can discover where you have to invest less money.

Spendee is complimentary on iPhone and Android with premium functions beginning at $1.99.

BUDGT

With BUDGT you can rapidly enter your income and your recurring expense for a summary of your budget and then begin tracking your everyday expenses in simple to manage categories to quickly see how much cash you have actually left and how much money you can spend.

BUDGT is an iPhone only app that delivers a personal spending plan with day-to-day tracking and alternatives to set a cost savings objective. You can likewise get suggestions, log transactions in multiple currencies and inspect out projections about how much cash you will have at completion of the month.

BUDGT is $1.99 for the iPhone.

Unsplurge

Unsplurge is another iPhone only budget app that assists you with budgeting in a various way. This budgeting app is all about conserving up for a specific splurge.

This makes it more fun to use, especially when you save approximately an objective like a holiday, a new iPhone Sixes or another significant fun purchase.

You can log your development, get assist from the community and discover ideas and tricks to stick to your goal.

Unsplurge is a free iPhone app.

Digit Bot

The Digit bot has actually been around because 2015 and because time it has actually assisted users save $250 million by immediately saving loan that the user does not need.

With this service you connect your checking account to Digit and the bot will monitor your spending to find out when and how much it can transfer from your monitoring into a savings account.

This works behind the scenes to automatically move cash out of monitoring and into a dedicated savings account. the company is including assistance for income tax return.

Digit is complimentary and readily available for iPhone and Android.

Albert Budget App

The Albert app is a safe and simple budget plan app that helps you make smarter financial decisions using your personal information. You link Albert to your bank, insurance, investments and loans and the app will recognize actions that you might have to take.

Albert monitors your accounts to help notify you to brand-new money and to assist you discover brand-new ways to use your cash. The app can likewise help you find out where you are spending money with subscriptions and repeating payments that you may wish to cut.

You’ll get a financial health rating that assists you recognize what you can do today to improve your financial circumstance. You can act on the recommendations Albert gives from inside the app, using connections to various loan providers and services, or you can go search by yourself.

The app can even assist you determine when you are overpaying for insurance, investing too much paying high-interest rates on cards and more. You can even use Albert to automate cost savings by wisely moving cash to a savings account that is FDIC guaranteed and that you can withdraw from at any time.

Albert is offered for the iPhone as a complimentary download without any in-app purchases. You can request early access to the Android app.

Why You Need a Budget

In 2013 the Customer Financial Protection Bureau revealed that the average yearly overdraft fees paid by customers were $225 and the study discovered that little debit purchases frequently pressed the account into an overdraft and insufficient funds fees could rapidly turn a little purchase into an expensive cost paid to the bank. These best budget plan apps can assist know how much remains in your account and how much you can invest with a look at your iPhone or Android instead of logging in to your checking account.

The biggest reasons not to budget plan are time, security and recovering from failures. Once you set up your budget with among these budgeting apps you can keep on track with notifications and simple to comprehend dashboards that show you how much cash you have. The best budget plan apps use the exact same security that banks do, so you aren’t compromising your security by connecting to a budgeting app.

When it comes to budgeting a failure is a simple reason to give up, especially when a major unexpected expenditure blasts your budget to pieces. Instead of quitting, you can regroup much like you would if you splurge and have a cheat weekend on a diet.

In a way a great budget plan is a lot like a great diet. You need to alleviate into it or you’ll lose your self-control after a week and you need a support group that can assist keep you on track. Finally you have to build in cheats. Produce part of your budget for enjoyable or for an unique item you wish to save up for like an iPhone 7 or a brand-new game console.